Few assets are more valuable to an individual than their ability to earn an income over their lifetime. For many, this can mean millions of dollars over the course of a career. Income is like the gas in the tank of your financial life, enabling you to pay the mortgage and basic living expenses, provide for health care needs, and to save for financial goals such as educating children and having a secure retirement.

So, what happens when a disabling event causes an interruption to income? Unfortunately, most financial obligations remain, and some new ones arise related to care and rehabilitation. It is no secret then that protecting income from the effects of a disabling injury or sickness is critical to establishing a sound, secure financial plan.

To help address this need, most employers offer Group Long-term Disability (LTD) coverage. Although LTD plans provide an essential foundation, they are typically not sufficient to meet the unique needs of all employees. Most group plans cover a small percentage of compensation, typically around 60%. Also, they have a cap on the maximum monthly benefit, usually between $5,000 and $10,000. And in many cases, they do not cover bonus or incentive compensation. Therefore, many employees are unable to adequately protect their income through group disability plans.

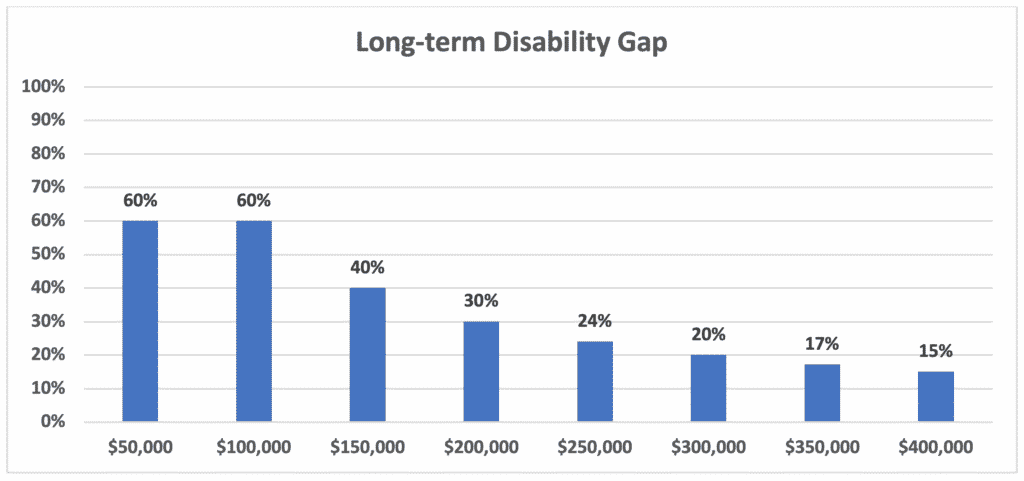

This income protection gap is illustrated in the graph below which shows the coverage at different base salary levels assuming a group LTD plan covering 60% of compensation up to a monthly maximum benefit of $5,000. As you can see, the higher the compensation, the lower the income replacement offered under the group plan due to the maximum benefit cap of $5,000. For example, an employee with a base salary of $150,000 only has 40% salary replacement under a “60%” LTD plan with a $5,000 monthly cap.

In response to this issue, employers will typically take one of two approaches:

Approach 1

Employers keep the Group LTD plan where it is with the understanding that impacted employees can purchase additional disability coverage on their own through an insurance agent or financial planner. This strategy seems to follow an egalitarian philosophy but in truth, it results in “reverse discrimination” as income increases. Furthermore, if employees choose to supplement their Group LTD coverage by purchasing supplemental disability insurance through an insurance agent or financial planner, they are paying full retail rates and are subject to a rigorous, complicated financial and medical underwriting process.

Approach 2

Employers raise the Group LTD monthly maximum benefit (i.e., from a common maximum of $5,000-$10,000 to a larger maximum monthly benefit) to provide all employees with more adequate levels of coverage. On the surface, this approach seems to make sense, however, it can create its own set of challenges, including:

- Increased premiums to the employer

- Higher concentration in one risk pool

- Claim history affects future rate increases for all employees

Fortunately, there is a better solution, corporate-sponsored individual disability insurance (IDI) program. Through these arrangements, employers can offer a program whereby employees purchase supplemental individual disability coverage at work. Since the plan is corporate-sponsored, it is available with significant premium discounts and underwriting concessions making the cost substantially lower and the process much more streamlined and efficient as compared to purchasing coverage through a retail insurance broker or financial planner.

And from a risk management standpoint, layering an individual disability insurance offering on top of the existing group LTD plan gives employers the ability to provide a more robust income protection program without increasing claims exposure in the group LTD plan.

IDI Solution-Advantages to Employer

- Highly visible and highly utilized providing a more attractive benefits package to aid in the recruitment and retention of key employees

- Ability to increase the amount of coverage available without negatively impacting group rates or increasing claims exposure

- No cost to offer the program to employees

IDI Solution-Advantages to Employee

- Policies are available at institutional pricing with premium discounts

- Policies feature simplified medical and financial underwriting

- Policies are individually owned and fully portable at the same discounted rates and negotiated contractual provisions

- Since coverage is purchased through work, the convenience of payroll deduction is available

In summary, through a corporate sponsored individual disability solution, employers can offer a valuable benefit enhancement at no additional cost and employees are able to obtain coverage on a much more favorable basis than if they pursued this coverage on their own.

- Self-Funding

- Data Analytics

- Ancillary Benefits & Absence Management

- Estate & Business Planning

- Executive Benefits

Phone: 678.904.9342

Toll Free: 800.837.0650

The Benefit Company

The Benefit Company